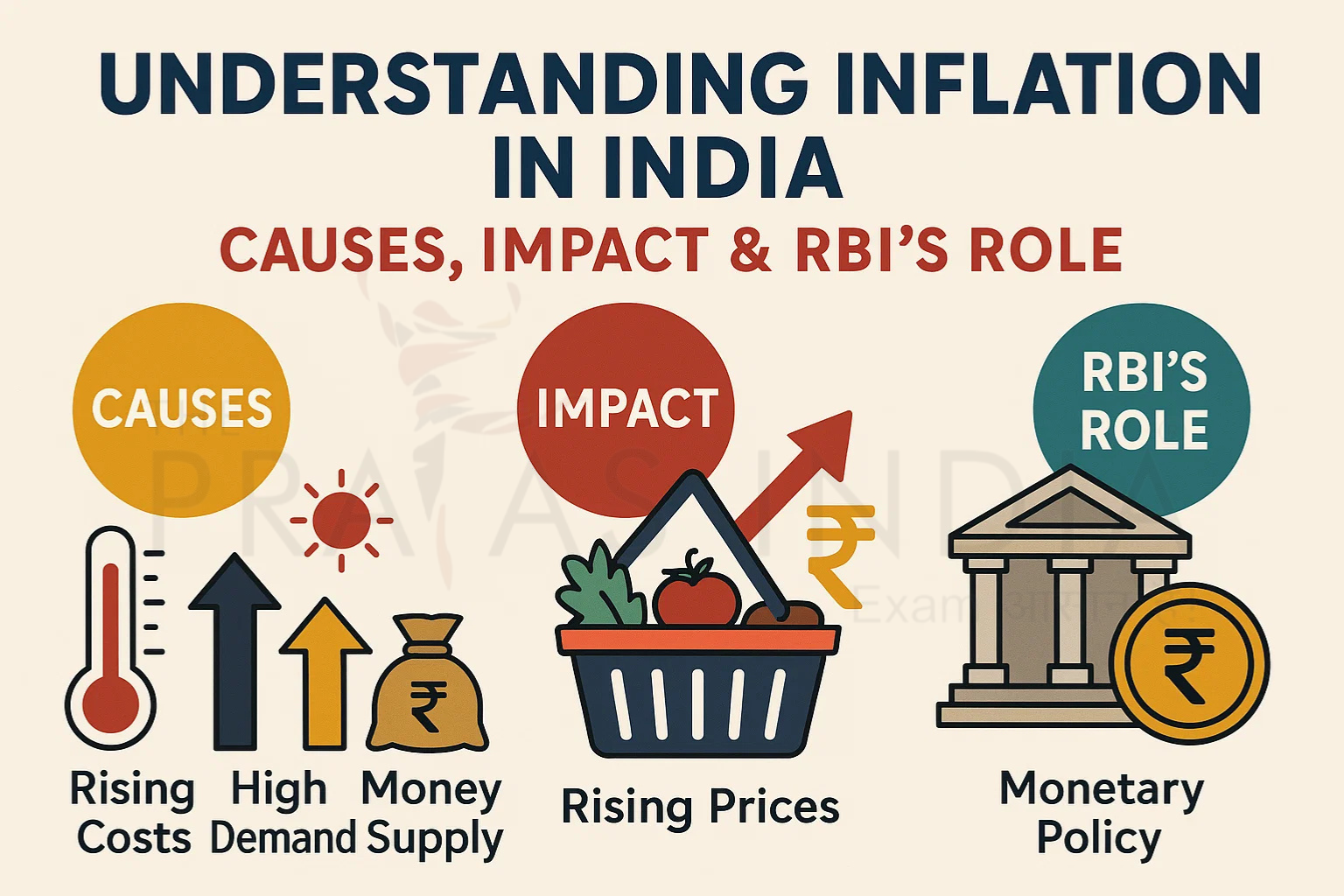

Understanding Inflation in India: Causes, Impact & RBI’s Role

Inflation continues to be one of the most critical challenges in managing India’s macroeconomic stability. Inflation affects every citizen and policymaker, from rising food prices to interest rate fluctuations. As of June 2025, the Reserve Bank of India (RBI) has made a notable policy shift by cutting the repo rate by 50 basis points, citing cooling inflation levels. This article explores inflation, its causes and effects in the Indian economy, and how the RBI works to keep it under control.

🔍 What is Inflation?

Inflation refers to the general increase in the prices of goods and services over time, reducing the purchasing power of money. It is usually measured using indices such as the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

A moderate level of inflation is considered a sign of a healthy, growing economy. However, when inflation rises too quickly or remains persistently high, it creates instability and hurts consumers, especially the poor and middle class.

📈 Current Inflation Scenario – June 2025

In its June 2025 Monetary Policy Review, the RBI noted that headline inflation has fallen below its 4% target, giving the central bank room to cut the repo rate to 6.25%. Contributing factors include:

-

Softening crude oil prices globally

-

Improved food supply chains due to better logistics and a favorable monsoon forecast

-

Base effect from high inflation during the same period last year

-

Global disinflation trends, especially in the U.S. and Europe

However, regional disparities exist. For instance, retail inflation in Punjab remains higher than the national average, signaling uneven price control across states.

🧭 Major Causes of Inflation in India

-

Demand-Pull Inflation:

Occurs when demand for goods and services exceeds supply. Post-pandemic economic recovery and increased consumption have often triggered such phases. -

Cost-Push Inflation:

Rising input costs—especially in fuel, energy, and raw materials—push prices upward. For India, global oil prices and imported goods play a major role. -

Food Price Volatility:

India’s inflation is highly sensitive to agricultural shocks, such as delayed monsoons or crop failures, which impact vegetable, cereal, and pulse prices. -

Supply Chain Disruptions:

Any disruption in logistics, transportation, or imports (e.g., during the Russia-Ukraine war or COVID-19 pandemic) leads to temporary price spikes. -

Imported Inflation:

A weak rupee raises the cost of imported goods, especially petroleum and electronics, contributing to inflationary pressure.

⚖️ Impact of Inflation on the Indian Economy

-

Consumers: Reduced purchasing power, especially for essential items like food, transport, and electricity.

-

Investors: Erodes real returns, especially on fixed income assets.

-

Businesses: Rising costs may reduce margins unless passed to consumers.

-

Government: Higher inflation increases subsidies and welfare costs, while also impacting bond yields and fiscal management.

-

Banks: Credit risk rises as people struggle with EMI repayments during inflation spikes.

🏦 RBI’s Role in Controlling Inflation

The Reserve Bank of India is tasked with maintaining price stability while ensuring economic growth. Its Monetary Policy Committee (MPC) meets every two months to assess economic indicators and adjust interest rates accordingly.

Tools the RBI uses to manage inflation:

-

Repo Rate:

RBI increases the repo rate to reduce money supply and control inflation. In June 2025, the repo rate was cut to 6.25% due to falling inflation. -

Reverse Repo Rate:

Encourages banks to park excess funds with RBI, reducing liquidity. -

Cash Reserve Ratio (CRR):

In June 2025, RBI also reduced the CRR, infusing more liquidity to stimulate growth. -

Open Market Operations (OMOs):

Buying/selling government bonds to regulate liquidity. -

Inflation Targeting Framework:

Under the Monetary Policy Framework Agreement (2016), the RBI targets 4% inflation with a ±2% tolerance band, continuing through 2026.

🔍 Why RBI Cut Rates in June 2025

With inflation cooling off below 4%, the RBI shifted focus from inflation control to growth stimulation. The repo rate cut aims to:

-

Make borrowing cheaper for businesses and households

-

Boost investment and consumption

-

Support India’s GDP growth, projected at 6.8% for FY 2025–26

-

Encourage housing, auto, and SME sectors with lower interest rates

📚 Relevance for UPSC & Banking Exams

Understanding inflation is essential for:

-

UPSC GS-III: Economic development, inclusive growth, budgeting, and monetary policy

-

Bank PO & RBI Grade B: Monetary tools, inflation management, and macro indicators

-

Essay & Interview: Real-life examples of RBI’s policy decisions and inflation control

Inflation is more than a rise in prices—it’s a reflection of the overall economic balance. While recent trends suggest a favorable outlook, the RBI’s vigilance and policy shifts remain key to maintaining stability. For aspirants, keeping track of these developments is crucial not only for exams but also to understand how economic decisions shape the nation’s future.

![Prayas-तेजस [UPSC CSE Sociology Optional] – Online & Offline](https://theprayasindia.com/wp-content/uploads/2025/09/Prayas-तेजस-UPSC-CSE-Optional-Subject-The-Prayas-India-300x300.png)

![Prayas-सूत्र [UPSC CSE Materials (Hardcopy)]](https://theprayasindia.com/wp-content/uploads/2025/09/Prayas-सूत्र-UPSC-CSE-Study-Materials-Hardcopy-The-Prayas-India-300x300.png)

![Prayas-मंत्रा [UPSC CSE CSAT]](https://theprayasindia.com/wp-content/uploads/2025/09/Prayas-मंत्रा-UPSC-CSE-CSAT-The-Prayas-India-300x300.png)

![Prayas सारथी [UPSC CSE One on One Mentorship]](https://theprayasindia.com/wp-content/uploads/2025/09/Prayas-सारथी-UPSC-CSE-One-on-One-Mentorship-The-Prayas-India-300x300.png)